Company Formation in Saudi Arabia (2025): A Complete Guide for Foreign Investors

Saudi Arabia is transforming into one of the world’s most investor-friendly destinations. With 100% foreign ownership, a simplified company registration process, and tax-friendly policies, starting a business in Saudi Arabia has never been more straightforward.

This 2025 guide provides a concise, actionable roadmap for foreign investors, detailing the formation process, costs, licensing options, and strategies for success.

Why Invest in Saudi Arabia in 2025?

Vision 2030 has transformed Saudi Arabia into a diversified, investor-friendly economy. Key benefits include:

- 100% Foreign Ownership: Full control in most sectors, no local sponsor required.

- Equal Legal Treatment: Foreign investors enjoy the same rights as Saudi nationals.

- Streamlined Registration: The Ministry of Investment (MISA) e-services platform simplifies setup.

- Tax Incentives: Special Economic Zones (SEZs) offer 0% corporate tax and customs duty exemptions.

- Strategic Location: Access to Europe, Asia, and Africa, ideal for logistics and trade.

Key Legal Reforms for Investors

- Simplified Licensing: The new Investment Law eliminates most MISA licensing requirements, requiring only standard Ministry of Commerce registration for most activities.

- Full Ownership: Foreigners can own 100% of businesses in services, agriculture, manufacturing, and select trading activities.

- Investor Protections: Equal legal rights and robust protections under the revised investment framework.

- Faster Setup: Approval times for LLCs and branch offices reduced to weeks.

Costs to Start a Business in Saudi Arabia?

Costs are influenced by the service, business type, and specific requirements, such as licensing, staffing, and office space. While most businesses, like LLCs, can start with a minimum capital as low as SAR 10,000, certain sectors such as trading may require a higher investment, including SAR 30 million and operational history in four international branches, depending on the scale. To ensure an accurate budget tailored to your needs, consulting with local experts is highly advisable.

Additionally, the Ministry of Investment is enhancing accessibility by not currently applying the SAR 12,000 registration fee or the SAR 64,000 license renewal fee, potentially lowering initial expenses.

Types of Business Licenses in Saudi Arabia

Each license type has specific requirements, including operational history or capital thresholds:

| License | Who It’s For | Main Requirements | Ownership |

| Service | IT, consulting, media, logistics, education | 1 year of global experience, small capital (~SAR 25k), financial docs | 100% foreign allowed |

| Industrial | Manufacturing & factories | Same as Service + environmental & ministry approvals | 100% foreign allowed |

| Trading (Commercial) | Import/export, retail, wholesale, e-commerce | Option A: 100% foreign → high capital (SAR 30m+) + branches abroad. Option B: JV with Saudi partner (25% share, lower capital) | Either 100% foreign (strict) or JV |

| Professional | Legal, engineering, consulting firms | For 100% ownership → 4+ branches worldwide, SAR 10m each, 7+ years’ experience. Otherwise JV with Saudi partner (25%). | JV or 100% foreign (harder) |

| Agricultural | Farming, livestock, agribusiness | 1 year of global experience, SAR 25k, ministry approvals | 100% foreign allowed |

| Entrepreneur / Startup | Innovative or tech startups | Backing from VC or gov entity, prove innovation/IP, capital varies | Usually 100% foreign |

| Real Estate | Property development | Project worth SAR 30m+, can’t be in Mecca/Medina | Foreign if large projects |

| Mining | Mineral exploration & extraction | 1 year of global experience, SAR 25k | 100% foreign allowed |

| Regional HQ (RHQ) | Multinationals running MENA HQ | Must have global presence, 15 staff in year 1, no direct sales | For large foreign corporations |

Best Business Structures

| Structure | Best For | Capital (SAR) | Shareholders |

|---|---|---|---|

| LLC | SMEs | 10,000 | 2–50 |

| JSC | Large corporations | 10M (public) | 5+ |

| Branch Office | International expansion | None | N/A |

| Regional HQ | Multinational oversight | Varies | N/A |

LLC is the most popular due to its low capital requirement and flexibility.

Step-by-Step Company Formation Process

Total Timeline: 2–3 months to full operation.

Phase 1: Pre-Setup (2–3 weeks)

- Select license type based on business activity (e.g., trading requires SAR 30M and four international branches).

- Choose structure (LLC recommended for most).

- Prepare documents: passport copies, commercial registration, financial statements, business plan (mandatory for licenses).

Phase 2: Registration (1–2 weeks)

- Reserve company name via Ministry of Commerce.

- Submit application on MISA e-services (investsaudi.sa).

- Pay business license fees (SAR 5,000–30,000).

Phase 3: Incorporation (2–4 weeks)

- Draft Articles of Association (outlines operations).

- Obtain Commercial Registration (CR).

- Open a Saudi bank account and deposit capital (e.g., SAR 10,000 for LLC).

- Register with GOSI (social insurance) and secure municipal license.

Phase 4: Operational Setup (4–8 weeks)

- Hire a General Manager (mandatory).

- Apply for employee work visas.

- Register for VAT if revenue exceeds SAR 375,000 annually.

- Complete final inspections.

High-Growth Sectors for 2025

- Technology & AI: $135B projected contribution by 2030. Startups benefit from funding and SEZ incentives.

- Construction & Real Estate: High demand for FIFA 2034 and Expo 2030 infrastructure.

- Tourism: Targeting 100M tourists, with opportunities in hospitality and travel tech.

- Renewable Energy: Solar and wind projects under the National Renewable Energy Program.

- Healthcare: Growth in hospitals, telemedicine, and biotech due to privatization.

- Logistics: Strategic hub for Europe, Asia, and Africa, ideal for warehousing and trade (requires SAR 30M for trading license).

Restricted Sectors

- Fully Restricted: Oil exploration, real estate in Makkah/Madina, defense, certain telecoms.

- Partially Restricted: Banking, insurance, some professional services (require local partner or special approvals).

Special Economic Zones (SEZs)

Saudi Arabia’s four Economic Cities and five SEZs offer:

- 0% corporate tax.

- 100% foreign ownership.

- Customs duty exemptions.

- World-class infrastructure.

Contact the Saudi Economic Cities Authority for details.

Practical Tips for Success

Do’s:

- Start Early: Begin licensing in the 11th month to avoid delays.

- Hire Experts: Legal and HR consultants ensure compliance with Saudization (5–75% local hires).

- Leverage SEZs: Maximize tax and operational benefits.

- Plan Capital: Ensure SAR 30M for trading or SAR 10M for professional licenses where required.

Don’ts:

- Don’t skip VAT registration or municipal licensing.

- Don’t delay visa processing.

- Don’t ignore Saudization quotas.

Key Requirements Checklist

| Document | Purpose |

|---|---|

| Articles of Association | Outlines business operations |

| Business Plan | Required for license approval |

| Passport Copies | Identity verification |

| Financial Statements | Proof of financial capability |

| Power of Attorney | If using a representative |

Common Challenges & Solutions

| Challenge | Solution |

|---|---|

| Saudization quotas | Engage local HR advisors |

| Cultural misunderstandings | Use local consultants, learn etiquette |

| Bureaucratic delays | Hire experts with MOI/GOSI experience |

| Language barriers | Use certified translators for filings |

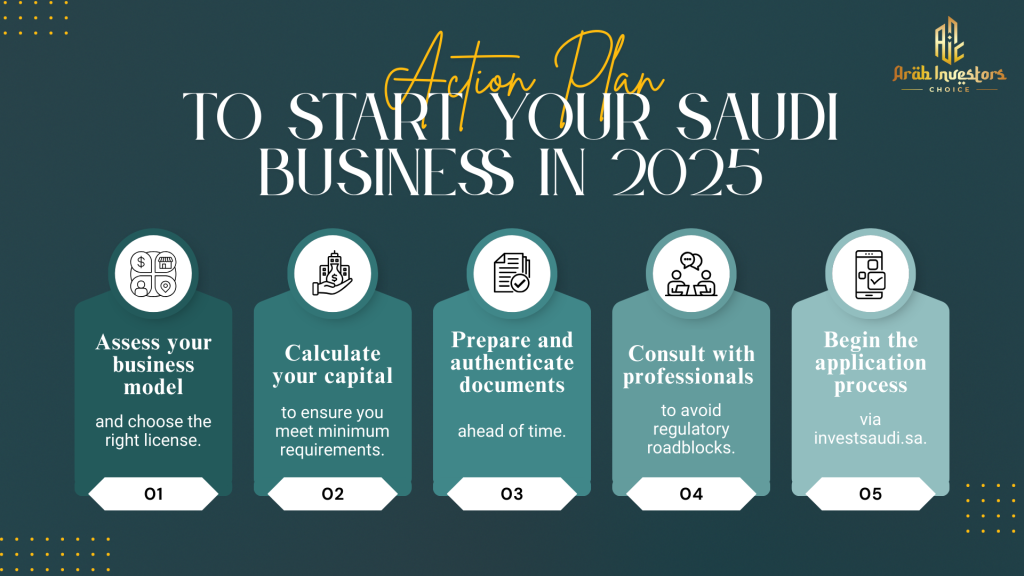

Action Plan for 2025

Key Portals:

- Assess business model and select license (e.g., trading needs SAR 30M and four branches).

- Verify capital requirements (SAR 10,000 for LLC, SAR 10M for JSC).

- Prepare and authenticate documents.

- Engage consultants to navigate regulations.

- Apply via investsaudi.sa.

- MISA E-Services: investsaudi.sa

- Ministry of Commerce: mc.gov.sa

- Government Services: absher.sa

Why Saudi Arabia in 2025?

- Market Access: $1.1 trillion economy, 20% corporate tax, no personal income tax.

- Efficiency: 2–3 months to full operation.

- Investment: ~USD 113,000 for first-year setup (reduced due to waived fees).

- Growth: High returns in tech, tourism, and logistics.

Saudi Arabia in 2025 is a dynamic, accessible market for foreign investors. With preparation and expert support, your business can thrive in this fast-growing economy.